Sean Hannity claimed that the United States is “going to lose our AAA bond rating because [President Obama] spent us into oblivion.” In fact, most of the current deficit and projected deficits can be attributed to a decrease in revenue due to the economic downturn, as well as policies already in place when Obama took office.

Hannity Wrongly Blames Debt-Ceiling Crisis On Obama Policies

Written by David Shere

Published

Hannity Blames Possibility Of U.S. Credit Downgrade On Obama Spending “Us Into Oblivion”

Hannity: “Look At Standard And Poor's And Moody's. We're Going To Lose Our AAA Bond Rating Because [Obama] Spent Us Into Oblivion.” From Fox News' Hannity:

HANNITY: Look at these numbers. Look at Standard and Poor's and Moody's. We're going to lose our AAA bond rating because he spent us into oblivion. The IMF says China takes over our economy in five years.

We've given him -- he's got everything he wanted, and every promise he made, he has driven this economy -- to use his analogy -- in a ditch, and we can't get out of it. Why wouldn't you support Cut, Cap, and Balance?

[...]

HANNITY: If we become Greece, it's because they have spent too much money and they cannot -- it's like crack cocaine for these guys in Washington. They're addicted to it. They get their power from it. [Fox News, Hannity, 7/18/11]

But Most Of The Deficit Results From Pre-Obama Policies And The Downturn

CBO Projected $1.2T Deficit In January 2009 Based On Spending Bush Authorized; Actual Deficit Was $1.4T. In a January 7, 2009, report, the Congressional Budget Office (CBO) projected, based on spending authorized under the Bush administration, that the federal deficit in FY2009 would total $1.2 trillion. According to the CBO, the actual federal deficit for FY2009, which began during the Bush's last year in office, was $1.4 trillion. [CBO, January 2009 and January 2010]

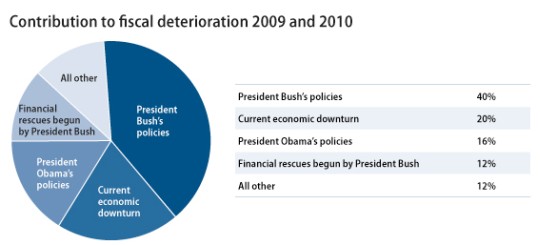

CAP: “Single Most Important [Cause Of The Deficit] Is The Legacy Of President George W. Bush's Legislative Agenda.” In an August 2009 analysis, the Center for American Progress (CAP) concluded that about two-thirds of the then-projected budget deterioration for 2009 and 2010 could be attributed to either Bush's policies or the economic downturn:

The report explained:

As for the deficit's cause, the single most important factor is the legacy of President George W. Bush's legislative agenda. Overall, changes in federal law during the Bush administration are responsible for 40 percent of the short-term fiscal problem. For example, we estimate that the tax cuts passed during the Bush presidency are reducing government revenue collections by $231 billion in 2009. Also, because of the additions to the federal debt due to Bush administration policies, the government will be paying $218 billion more in interest payments in 2009.

Had President Bush not cut taxes while simultaneously prosecuting two foreign wars and adopting other programs without paying for them, the current deficit would be only 4.7 percent of gross domestic product this year, instead of the eye-catching 11.2 percent--despite the weak economy and the costly efforts taken to restore it. In 2010, the deficit would be 3.2 percent instead of 9.6 percent.

The weak economy also plays a major role in the deficit picture. The failure of Bush economic policies--fiscal irresponsibility, regulatory indifference, fueling of an asset and credit bubble, a failure to focus on jobs and incomes, and inaction as the economy started slipping--contributed mightily to the nation's current economic situation. When the economy contracts, tax revenues decline and outlays increase for programs designed to keep people from falling deep into poverty (with the tax impact much larger than the spending impact). All told, the weak economy is responsible for 20 percent of the fiscal problems we face in 2009 and 2010.

President Obama's policies have also contributed to the federal deficit--but only 16 percent of the projected budget deterioration for 2009 and 2010 are attributable to those policies. The American Recovery and Reinvestment Act, designed to help bring the economy out of the recession is, by far, the largest single additional public spending under this administration. [CAP, 8/25/09]

CBPP: "[V]irtually The Entire Deficit Over The Next Ten Years" Due To Bush Policies, Economic Downturn." The Center on Budget and Policy Priorities (CBPP) published an analysis of federal deficits in December 2009, which was most recently updated on June 28, 2010, titled, “Critics Still Wrong on What's Driving Deficits in Coming Years: Economic Downturn, Financial Rescues, and Bush-Era Policies Drive the Numbers.” The report noted:

Some critics continue to assert that President George W. Bush's policies bear little responsibility for the deficits the nation faces over the coming decade -- that, instead, the new policies of President Barack Obama and the 111th Congress are to blame. Most recently, a Heritage Foundation paper downplayed the role of Bush-era policies (for more on that paper, see p. 4). Nevertheless, the fact remains: Together with the economic downturn, the Bush tax cuts and the wars in Afghanistan and Iraq explain virtually the entire deficit over the next ten years.

The report also graphed the effects of Bush's policies and the wars in Iraq and Afghanistan on the deficit. From the report:

[CBPP, updated 6/28/10, emphasis in original]

Harvard Business Review Group Director: "[T]he Giant Deficit Is Mainly The Result Of The Collapse In Tax Receipts Brought On By The Recession." In an October 2010 post on his Reuters blog, Justin Fox, editorial director of the Harvard Business Review Group, analyzed the deficit and concluded that it was “mainly the result of the collapse in tax receipts brought on by the recession”:

The Treasury Department reported on Oct. 15 that the deficit in fiscal 2010, which ended Sept. 30, was $1.294 trillion. That's less than FY 2009's $1.416 trillion, but it's still really really big. Why is it so big, though? Is it because of all that stimulus and bailout spending? Or is something else going on?

To find out, I created a fantasy world. I figured out how fast federal spending and revenue grew over the last business cycle, from 2000 through 2007, and calculated where we'd be today if those growth rates had continued through 2010. I was originally motivated to do this for a commentary that's supposed to air tomorrow night on Nightly Business Report. But I'm thinking there's not a huge overlap between Felix Salmon readers and Nightly Business Report viewers, so I'll go ahead and share what I learned.

In my no-financial-crisis, no-bailout, no-recession, no-stimulus scenario, spending kept growing at 6.22% a year, and revenue kept growing at 3.45%. You can see from the difference between the two numbers that this was an unsustainable path. But it clearly could have been sustained for a few more years.

Where would it have left us in fiscal 2010? With $2.843 trillion in federal revenue and $3.270 trillion in spending, leaving a deficit of $427 billion. The actual revenue and spending totals for 2010 were $2.162 trillion and $3.456 trillion. So spending was $186 billion higher than if we'd stuck to the trend, and revenue was $681 billion lower. In other words, the giant deficit is mainly the result of the collapse in tax receipts brought on by the recession, not the increase in spending. Nice to know, huh? [Justin Fox, blogs.reuters.com, 10/25/10, emphasis added]